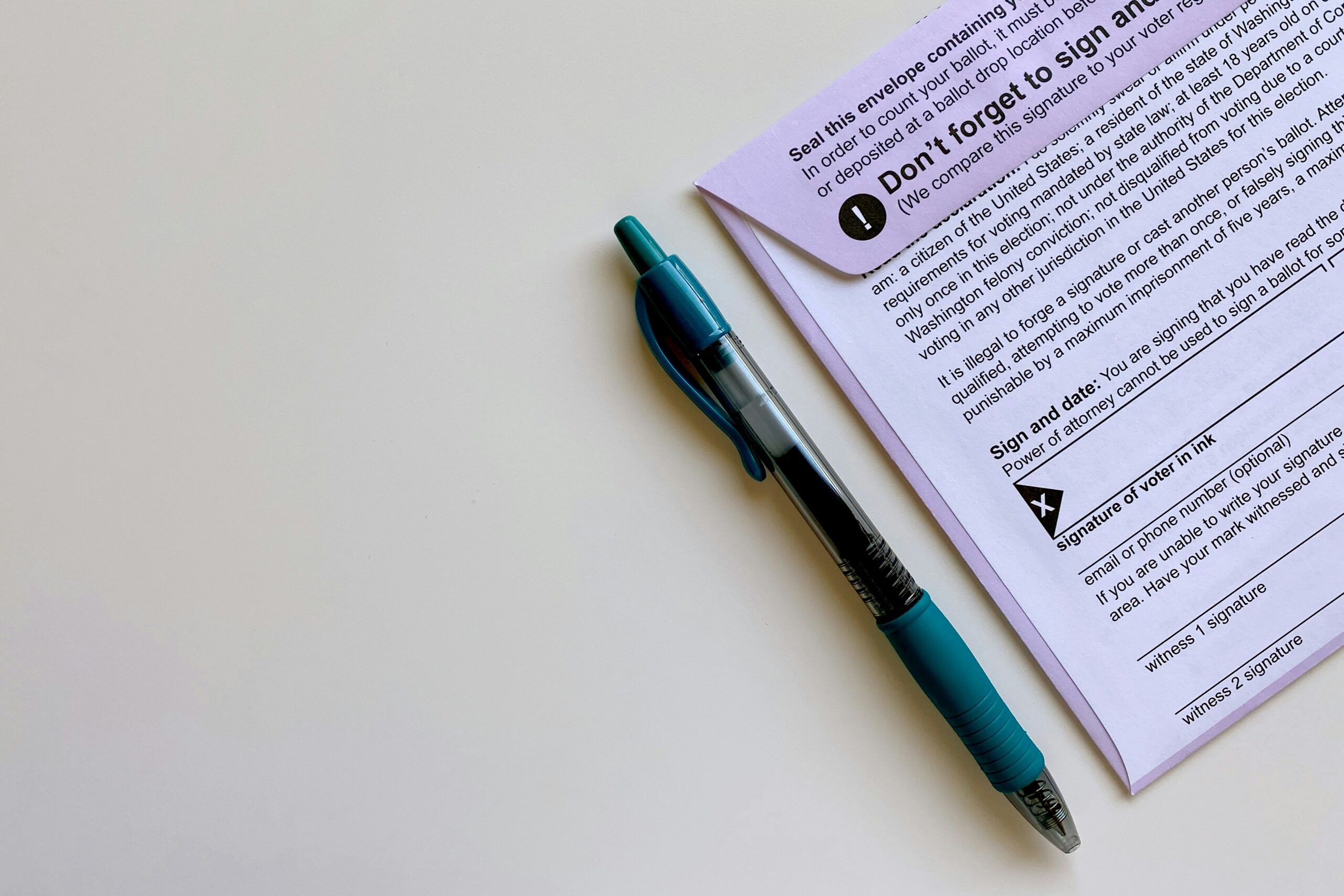

The Impact of Election Results on International Trade

The outcome of the recent elections could potentially lead to significant shifts in existing trade agreements. With new leadership in place, there might be a reevaluation of trade policies and priorities, which could impact the current agreements in place. The focus may shift towards renegotiating terms or even withdrawing from certain agreements altogether, depending on the stance of the new government.

Trade partners are closely monitoring the developments post-election to assess how their existing agreements may be influenced. Uncertainty in trade relations can lead to fluctuations in market dynamics, impacting businesses and investors alike. The potential alterations in trade agreements may result in both challenges and opportunities for economies involved, requiring them to adapt swiftly to the changing landscape of international trade.

Shifts in Global Economic Alliances

The outcome of recent elections in key countries has sparked speculation about potential shifts in global economic alliances. With new leadership comes the possibility of reevaluating existing trade relationships and forming strategic partnerships that align with the country’s economic interests.

These shifts could have far-reaching implications on global trade dynamics, as countries reassess their positions and redefine their economic priorities. As alliances evolve, it will be crucial for businesses to stay informed and adapt to the changing landscape to effectively navigate the new opportunities and challenges that may arise.

Market Reactions to Election Outcomes

Following the recent election outcomes, markets have displayed significant volatility. Price fluctuations have been observed across various sectors and industries, reflecting the uncertainty and apprehension surrounding the new political landscape. Investors are closely monitoring the developments and adjusting their portfolios accordingly to navigate the shifting market conditions effectively.

The election results have triggered mixed reactions among market participants, with some expressing optimism about potential economic policies that could be implemented, while others remain cautious due to the perceived political instability. This divergence in opinions has contributed to heightened market turbulence, with rapid changes in asset prices and trading volumes. It remains to be seen how the markets will continue to react in the coming days as more information regarding the new administration’s agenda becomes available.

Market volatility has been significant following recent election outcomes

Price fluctuations seen across various sectors and industries

Investors closely monitoring developments and adjusting portfolios accordingly

Mixed reactions among market participants to election results

Some express optimism about potential economic policies, while others remain cautious due to perceived political instability

How do trade agreements typically impact market reactions to election outcomes?

Trade agreements can have a significant impact on market reactions to election outcomes, as changes in leadership may signal shifts in trade policies and agreements, leading to fluctuations in the market.

What are some potential implications of election outcomes on global economic alliances?

Election outcomes can potentially lead to shifts in global economic alliances, as new leaders may prioritize different international relationships and partnerships, which can impact markets and economic stability.

How do markets typically react to unexpected election outcomes?

Markets can react unpredictably to unexpected election outcomes, with potential volatility and fluctuations in response to uncertainties surrounding future policies and leadership changes.

What factors influence market reactions to election outcomes?

Market reactions to election outcomes can be influenced by a variety of factors, including economic policies proposed by new leaders, stability of government institutions, and overall market sentiment.

How can investors prepare for potential market reactions to election outcomes?

Investors can prepare for potential market reactions to election outcomes by diversifying their portfolios, staying informed on political developments, and seeking professional financial advice to navigate uncertain market conditions.